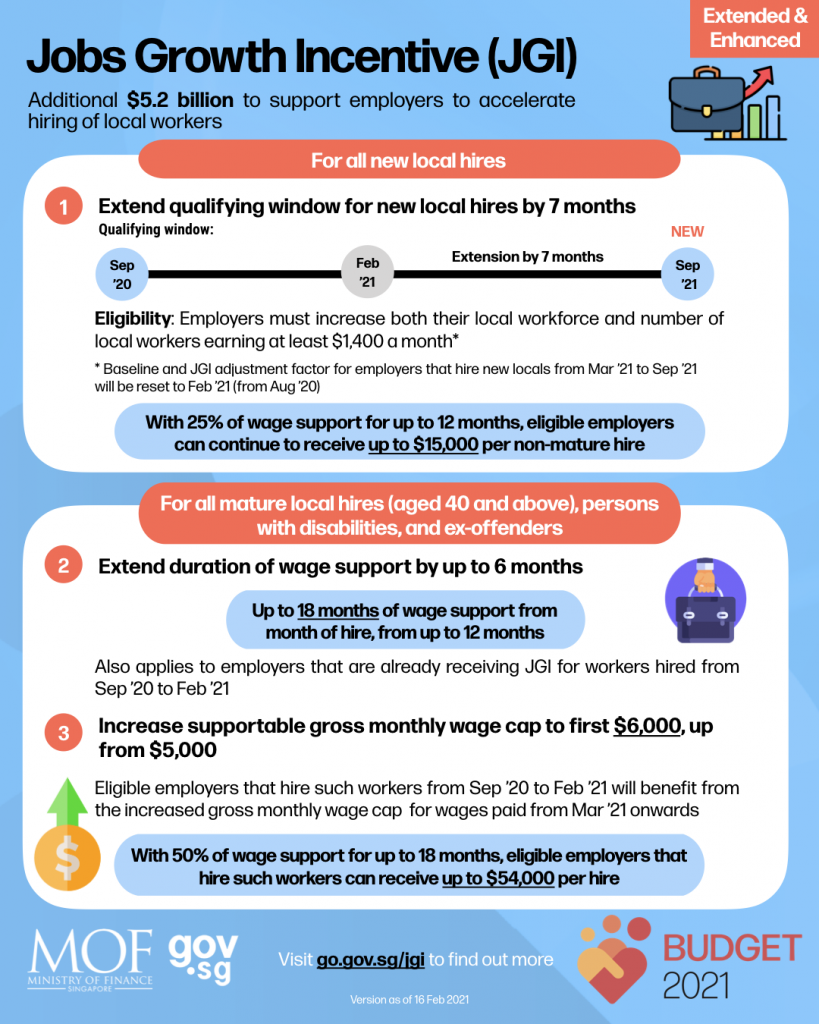

The Recruitment Incentive Scheme (JGI) supports employers to expand local recruitment* between September 2020 and September 2021 inclusive in order to create good, long-term employment opportunities for local people.JGI will provide up to 12 months’ wage support for each immature local employee and 18 months’ wage support for each mature employee, disabled or ex-offender employee who seeks to increase their local workforce during the qualifying window.

Note*: Local recruitment refers to the employment of Singapore citizens or permanent residents

- Phase 1 of the JGI: September 2020 to February 2021

- Phase 2 of JGI: March 2021 to September 2021

Who is eligible for the JGI?

Eligibility for the JGI is dependent on the month the hiring of new locals was achieved.

To be eligible for Phase 1, all employers who have made timely mandatory CPF contributions and achieved the following increases in their local workforce between September 2020 and February 2021 (inclusive), compared to the August 2020 local workforce, i.e. the baseline headcount:

Condition 1 – Increase in overall local workforce;AND

Condition 2 – Increase in local employees earning gross wages of at least $1,400 per month

Employers must have been established on or before 16 August 2020 to be eligible.

To be eligible for Phase 2, all employers who have made timely mandatory CPF contributions and achieved the following increases in their local workforce between March 2021 and September 2021 (inclusive), compared to the February 2021 local workforce, i.e. the baseline headcount:

Condition 1 – Increase in overall local workforce; AND

Condition 2 – Increase in local employees earning gross wages of at least $1,400 per month

Employers must have been established on or before 15 February 2021 to be eligible.

To receive the JGI for full 12 months or 18 months from the month of hire for each new local hire (depending on worker profile), the employer must have qualified for JGI during the eligibility period for each phase (i.e. September 2020 to February 2021 or March 2021 to September 2021), and continually meet the eligibility criteria for the entire payout period.

How do I apply for or decline the JGI?

Employers do NOT need to apply for the JGI. IRAS will notify eligible employers by post of the amount of JGI payout payable to them. They can also log in to myTax Portal to view the electronic copy of their letter.

How is each payout computed?

The JGI payout is computed on a monthly basis based on the eligible employer’s mandatory CPF contributions.

For (i) all new mature local hires aged 40 and above, (ii) all new local PwDs hired (regardless of age) and (iii) all new ex-offenders hired (regardless of age), the Government will co-fund up to 50% of the first $5,000 of gross monthly wages between September 2020 and February 2021.

From March 2021 onwards, for (i) all new mature local hires aged 40 and above, (ii) all new local PwDs hired (regardless of age) and (iii) all new ex-offenders hired (regardless of age), the Government will co-fund up to 50% of the first $6,000 of gross monthly wages.

For all other new local hires, the Government will co-fund up to 25% of the first $5,000 of gross monthly wages.

To receive the JGI for the full 12 months or 18 months from the month of hire for each new local hire (depending on worker profile), the employer must have qualified for JGI during the eligibility period for each phase (i.e. September 2020 to February 2021, or March 2021 to September 2021), and continually meet the eligibility criteria for the entire payout period. Otherwise, they will receive the JGI only for months where they meet the eligibility criteria.

Employers that did not meet the eligibility criteria for the JGI at least once in the eligibility period for each phase will not receive the JGI even if they meet the employer eligibility criteria from March 2021 onwards (for Phase 1) or October 2021 onwards (for Phase 2).