Under current Singapore regulations, not all companies are required to undergo a statutory audit. The Accounting and Corporate Regulatory Authority of Singapore (ACRA) introduced a new “small company” concept in July 2015, which will determine whether your company is exempt from a statutory audit.

A company qualifies as a small company if:

(a) it is a private company in the financial year in question; and

(b) it meets at least 2 of 3 following criteria for the immediate past two consecutive financial years:

1. total annual revenue ≤ $10m;

2. total assets ≤ $10m;

3. no. of employees ≤ 50.

For a company which is part of a group:

(a) the company must qualify as a small company; and

(b) the entire group must be a “small group”

to qualify for the audit exemption.

For a group to be a small group, it must meet at least 2 of the 3 quantitative criteria on a consolidated basis for the immediate past two consecutive financial years.

Where a company has qualified as a small company, it continues to be a small company for subsequent financial years until it is disqualified. A small company is disqualified if:

(a) it ceases to be a private company at any time during a financial year; or

(b) it does not meet at least 2 of the 3 quantitative criteria for the immediate past two consecutive financial years.

Where a group has qualified as a small group, it continues to be a small group for subsequent financial years until it does not meet at least 2 of the 3 quantitative criteria for the immediate past two consecutive financial years.

Assumption:

(a) The company is a private company throughout the period.

(b) The company’s FY2015 commences on or after 1 Jul 2015.

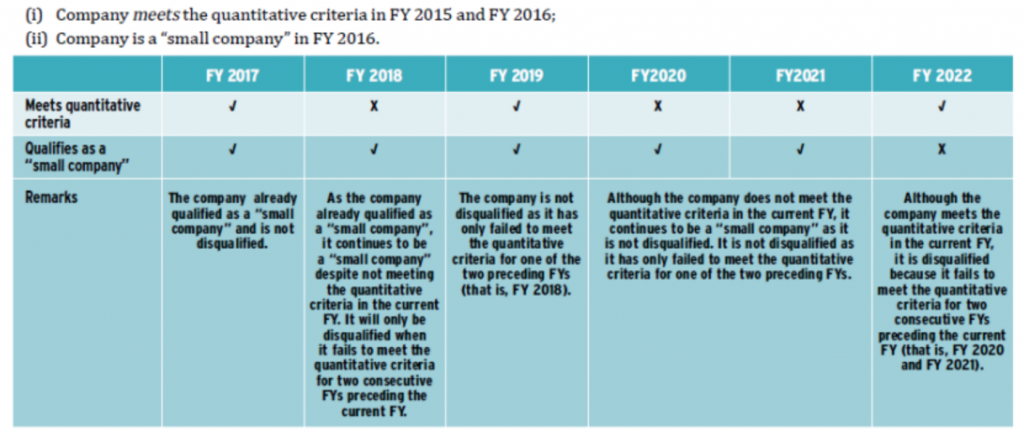

Scenario 1

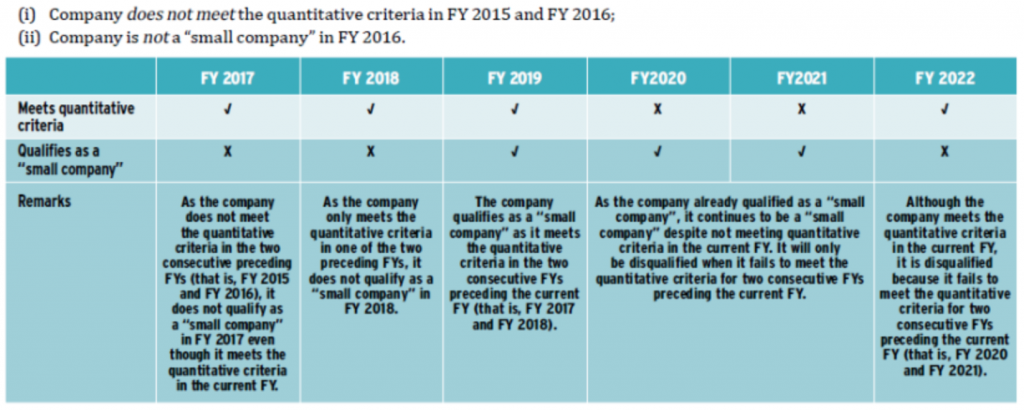

Scenario 2

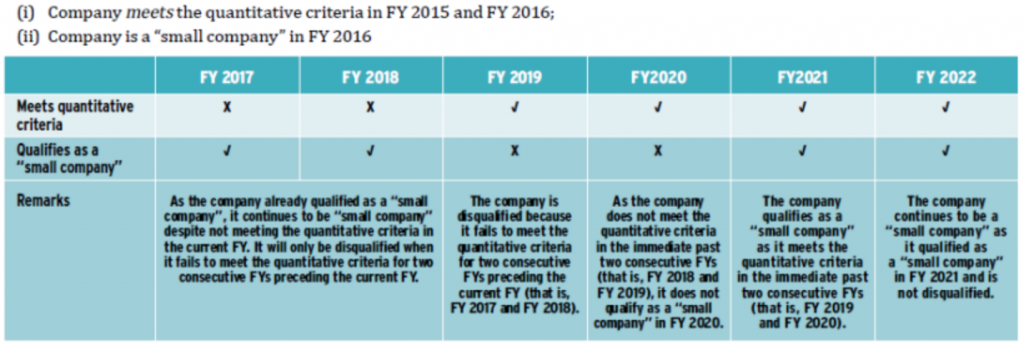

Scenario 3

Audit-exempt “small companies” are exempt from filing audit reports, which allows companies with “small company” status to reduce regulatory costs because there are fewer audit requirements. Although exempt from audit, companies are still required to provide unaudited financial reports. Audit reports are also required for companies with special licenses, such as those with travel licenses, or third-party finance companies.

If you have any further questions about statutory audits, you are welcome to consult our service team at any time.