Updates to the Employment Pass (EP) and S Pass requirements

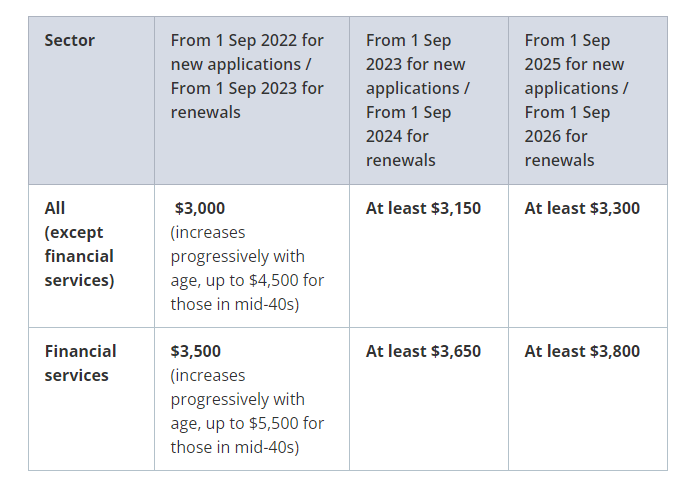

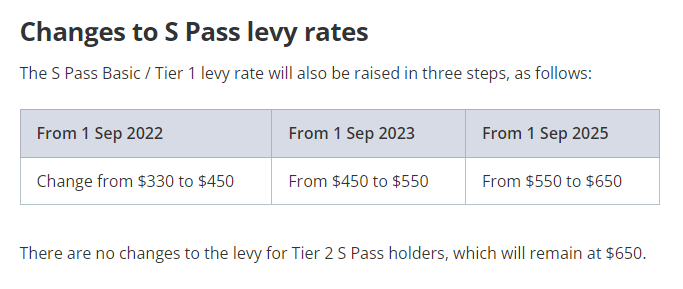

MOM will be raising the qualifying salaries and levies for S Pass holders, to uplift the quality of S Pass holders to the top one-third of our local APT workforce. These changes will apply progressively from 1 September 2022. S Pass quotas will also be updated from 1 January 2023.

Updates to EP qualifying salary

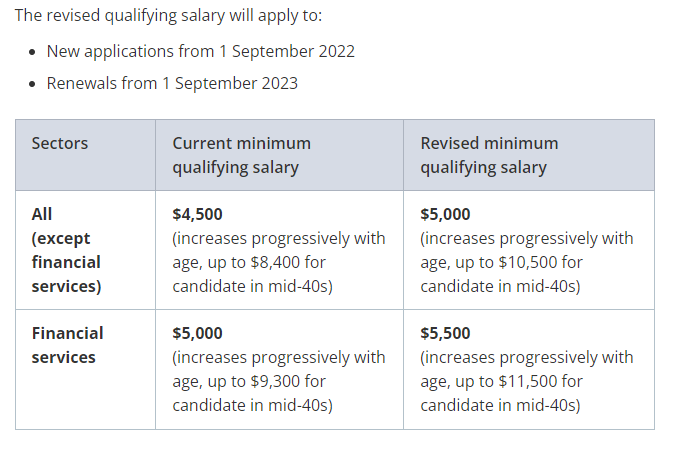

Updates to S Pass qualifying salary and levies

Ensures your employees’ names of CPF accounts are submitted as per their NRICs

CPF contributions are credited to your employees’ CPF accounts based on the NRIC numbers you have provided in your CPF submission.

From 1 August 2022, the Record of Payment (ROP) will indicate any mismatch between the new employees’ names you have provided and the names indicated in their NRICs.

You are reminded to rectify any errors promptly based on the follow-up actions indicated on the ROP as the mismatched employees’ name will only be flagged out once.

Click for Read more

CPF Board standardizes SMS sender ID

From 1 August 2022, CPF Board will send SMSes using only the sender ID “CPF Board” on matters pertaining to their CPF, Workfare and Silver Support. We will stop using sender IDs “SG-Workfare” and “SG-SSS”.

To prevent scammers from impersonating the CPF Board by sending SMSes using “CPF Board” sender ID, we have registered this new sender ID with the Singapore SMS Sender ID Registry (SSIR) set up by the Infocomm Media Development Authority (IMDA). Registering with SSIR identifies and blocks spoofed messages upfront. Only SMSes from CPF Board will be delivered using the sender ID “CPF Board”. Members can be assured that all SMSes from sender ID “CPF Board” are legitimate messages from us.

Click for Read more

Set up Electronic Standing Instruction (ESI) under CPF EZPay

The setting up of ESI is recommended if your employees’ wages do not vary each month. The monthly submission will be automatically calculated based on their wages and the CPF contributions will be automatically deducted.

Click for Read more

MinLaw extends application period for Simplified Insolvency Programme(SIP) to January 2024

The CPF contribution rates for employees aged above 55 to 70 will be increased to strengthen their retirement adequacy. The changes will apply to wages earned from 1 January 2023.

Click for Read more.