This article provides an overview of personal income taxation in Singapore. If you are interested to learn about corporate taxation, refer to Singapore corporate tax guide. To calculate estimated Singapore taxes and to compare how they stack up against those in your home country, refer to our online tax calculator.

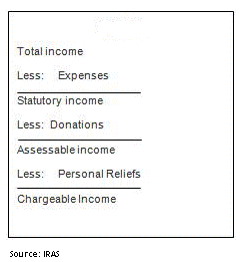

Personal income tax rates in Singapore are one of the lowest in the world. In order to determine the Singapore income tax liability of an individual, you need to first determine the tax residency and amount of chargeable income and then apply the progressive tax rate to it. Key points of Singapore income tax for individuals include:

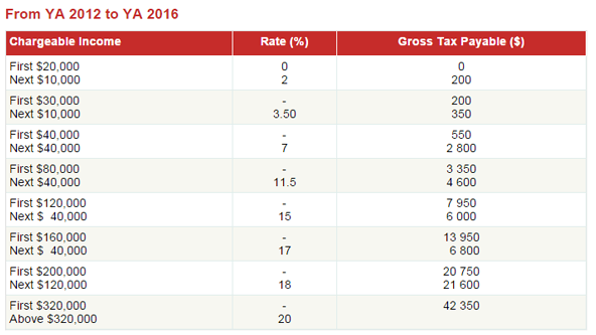

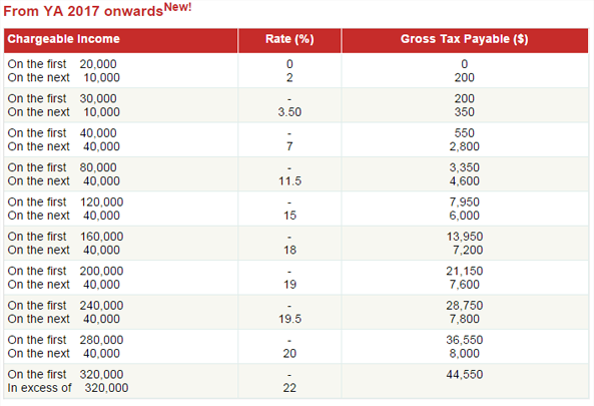

- Singapore follows a progressive tax rate starting at 0% and ending at 20% above S$320,000 (From 2016 onwards: will end at 22% above S$320,000).

- Individuals are taxed only on the income earned in Singapore. The income

earned by individuals while working overseas is not subject to taxation barring few exceptions. - Tax rules differ based on the tax residency of the individual.

- Tax filing due date for individuals is April 15 of each year. Income tax is assessed based on a preceding year basis.