In Times of Volatility, “Liquidity is King” – Singapore Elevates Asset Strategy

As geopolitical tensions and financial volatility increase worldwide, public markets are losing their traditional appeal. According to Northern Trust’s 2025 Global Asset Owners Peer Research Report, Singapore allocates 17% of managed assets to private markets, leading the Asia-Pacific region.

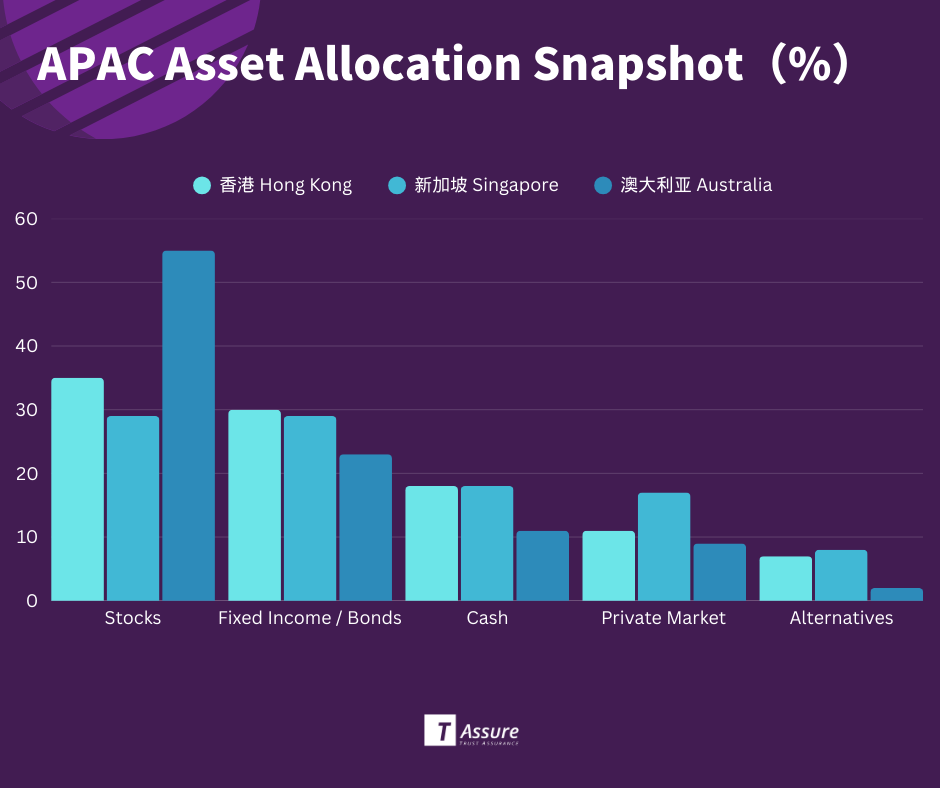

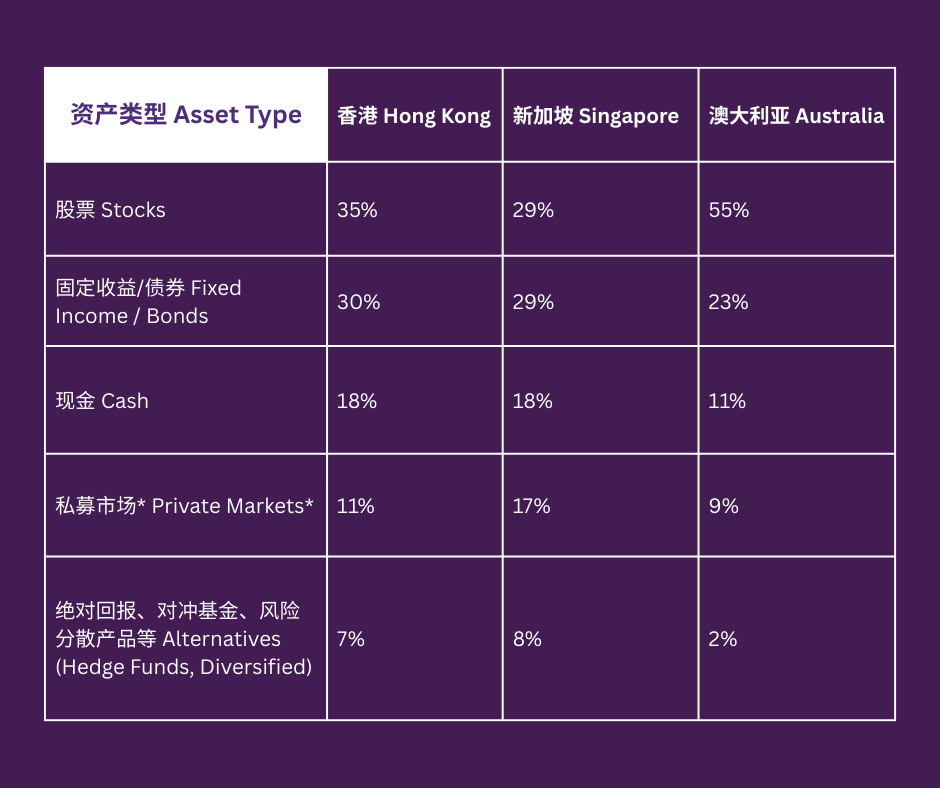

Singapore Tops in Private Markets, Least in Stocks

Singapore’s equity allocation stands at just 29%, the lowest among APAC peers—compared to Australia (55%), New Zealand (38%), and Hong Kong (35%). For bonds and fixed income, Singapore (29%) is second only to Hong Kong (30%).

Private Market Breakdown

In Singapore, 70% of private assets are allocated to commercial real estate, tied with Australia for the top spot in Asia-Pacific. 50% is directed toward residential and infrastructure projects, and 40% toward private equity and credit.

88% of APAC Asset Owners Are in Private Markets

The study surveyed 180 global asset owners, including OCIOs, pension funds, and family offices, managing assets from under $1B to over $500B. In Asia-Pacific, 88% of asset owners invest in private markets, outpacing North America (86%) and EMEA (83%). Singapore leads with 17% allocation, ahead of New Zealand (14%), Hong Kong (11%), and Australia (9%).

Why Are Private Markets Gaining Traction?

Leon Stavrou, Head of Northern Trust for Australia and New Zealand, highlighted that institutions of all sizes show consistent interest in private markets, indicating their strong appeal and lower correlation to public markets.

He noted, “Private assets may be illiquid, but that very feature helps offset market volatility, making them powerful tools for long-term portfolio stability.”

Singapore: The Most Liquidity-Conscious Market

80% of Singapore-based asset owners consider liquidity increasingly critical—the highest in Asia-Pacific, compared to 60% in Hong Kong, and 40% in both Australia and New Zealand.

The report adds that investors with higher cash allocations tend to engage in derivatives and collateralized strategies—prioritizing liquidity to manage market volatility and counterparty risk.