Despite continuing uncertainty made by the Covid-19 pandemic, the Government has decided to implement new property cooling measures to reduce the risk of a self-reinforcing cycle of price increases in the private and HDB resale markets, that will affect housing affordability.

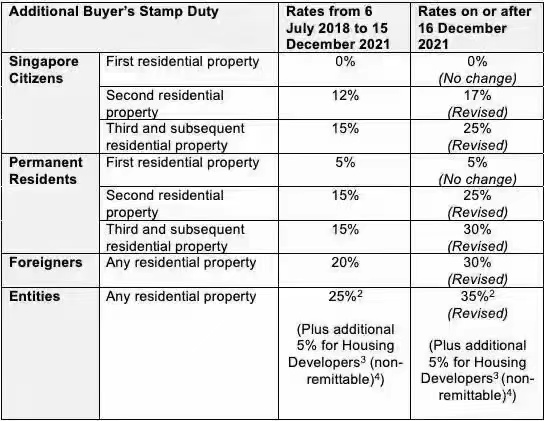

From 16 December 2021, the additional buyer’s stamp duty (ABSD) that should be paid for acquisition of extra properties will be raised.

The ABSD rate will go up from 12% to 17% for residents purchasing their second residential property, and from 15% to 25% for those purchasing their third and subsequent properties.

Permanent residents purchasing their second residential property will see the ABSD rate rise from 15% to 25%. Assuming that they are purchasing their third and resulting properties, the rate will increment from 15% to 30%.

Foreigners purchasing any residential property will pay an ABSD rate of 30%, up from 20% at this point.

The ABSD rate for entities, including housing designers, will go up from 25% to 35%. Housing developers can have this total waived if they comply with specific conditions, yet will still have to submit to the current standard under which they should pay an additional a 5% of ABSD that can’t be postponed.

The total debt servicing ratio (TDSR) for borrowers will likewise be tightened from 60% to 55%. The TDSR limits the amount that a person can spend on monthly debt repayments.

Housing Board loans will likewise be lowered from 90% down to 85% of a property’s purchase price.