Skills Development Levy (SDL) is a compulsory levy that you have to pay for all your employees working in Singapore, on top of CPF contribution and Foreign Worker Levy. CPF Board collects SDL on behalf of the SkillsFuture Singapore Agency (SSG).

You have to pay SDL for all your employees working in Singapore, including:

- employees employed on permanent, part-time, casual and temporary basis

- foreign employees on work permits and employment pass holders

The SDL for foreign employees is in addition to the Foreign Worker Levy payable to the Ministry of Manpower.

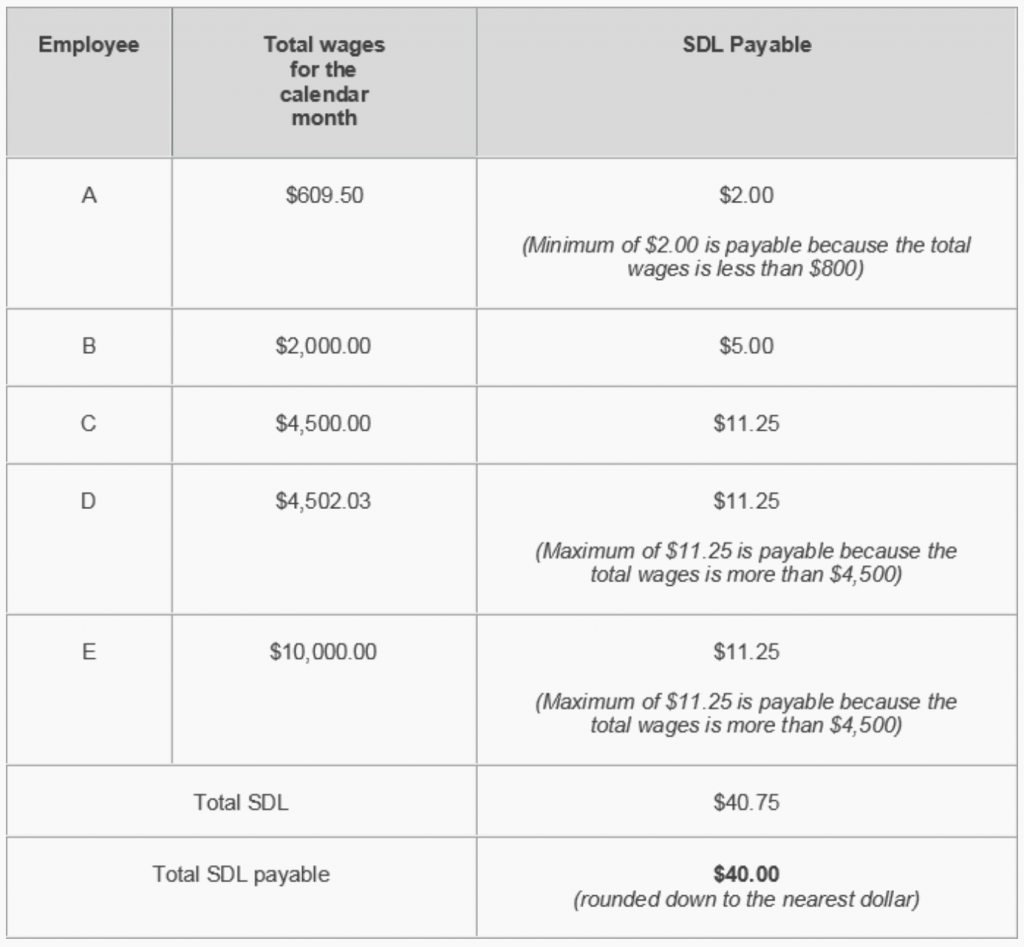

You can use the Skills Development Levy Calculator at the SkillsFuture Singapore Agency (SSG) website to compute the total SDL payable. Under the SDL Act, you are required to contribute SDL for all your employees* up to the first $4,500 of each employee’s total monthly wages at a levy rate of 0.25% or a minimum of $2 (for total wages of $800 or less), whichever is higher.

* Employees include full-time, casual, part-time, temporary and foreign employees rendering services wholly or partly in Singapore.

The total monthly wages includes any salary, commission, bonus, leave pay, overtime pay, allowance and other payments in cash.

After you have computed the SDL for each employee, you need to add up the total amount of SDL payable and round down to the nearest dollar. The table below shows an example on the computation of the SDL payable.