XBRL, known as eXtensible Business Reporting Language, is an XML-based language used to standardize the presentation format of financial statements.

Why do I need to prepare XBRL?

Most companies currently file their financial statements in PDF format. The Accounting and Corporate Regulatory Authority of Singapore (ACRA) believes that the use of XBRL will achieve the goal of facilitating business development in Singapore by providing more value-added financial information, enhancing the regulatory climate, improving transparency, and disseminating various financial information in a timely manner.

At the same time, XBRL filings reduce manual work for auditors, regulators, financial analysts, and financial institutions. The benefits are outstanding, and the entire data processing process is streamlined through the use of electronic tags.

Which companies need to prepare XBRL?

According to ACRA, all companies (limited or unlimited companies), including dormant companies, are required to file XBRL financial statements in accordance with the filing requirements. However, if you are a solvent individual shareholder or company, or a dormant company applying for an exemption, you do not need to prepare XBRL, as explained in more detail below.

When do I file XBRL?

XBRL needs to be submitted when your company filing its annual return, so you will need to prepare the relevant financial reports before your annual return.

How many types of XBRL are there? How do I choose?

Preparing data for XBRL filing is a tedious and time-consuming task. there are two types of XBRL filing.

– Full XBRL financial statements, i.e. “FULL XBRL”

– Summary financial statements in XBRL format, i.e. “FSH”

Full XBRL financial statements are used when you need to present the complete company accounts (each account line item) in XBRL format.

Summary Financial Statements are used when you need to present the status of key accounts in XBRL format.

Depending on your compliance needs, our team of professional accountants will assist you in completing the FULL XBRL or FSH format.

Can my company apply for an exemption from XBRL?

Companies may apply for exemption from specific business rules in filing your financial statements in XBRL format (e.g. removing the requirement for comparative periods in your financial statement, given valid reasons).

Please note that exemption requests are evaluated on a case-by-case basis, and you may contact our service team to make a reasonable recommendation based on your company’s circumstances.

What type of financial report does my company need to file?

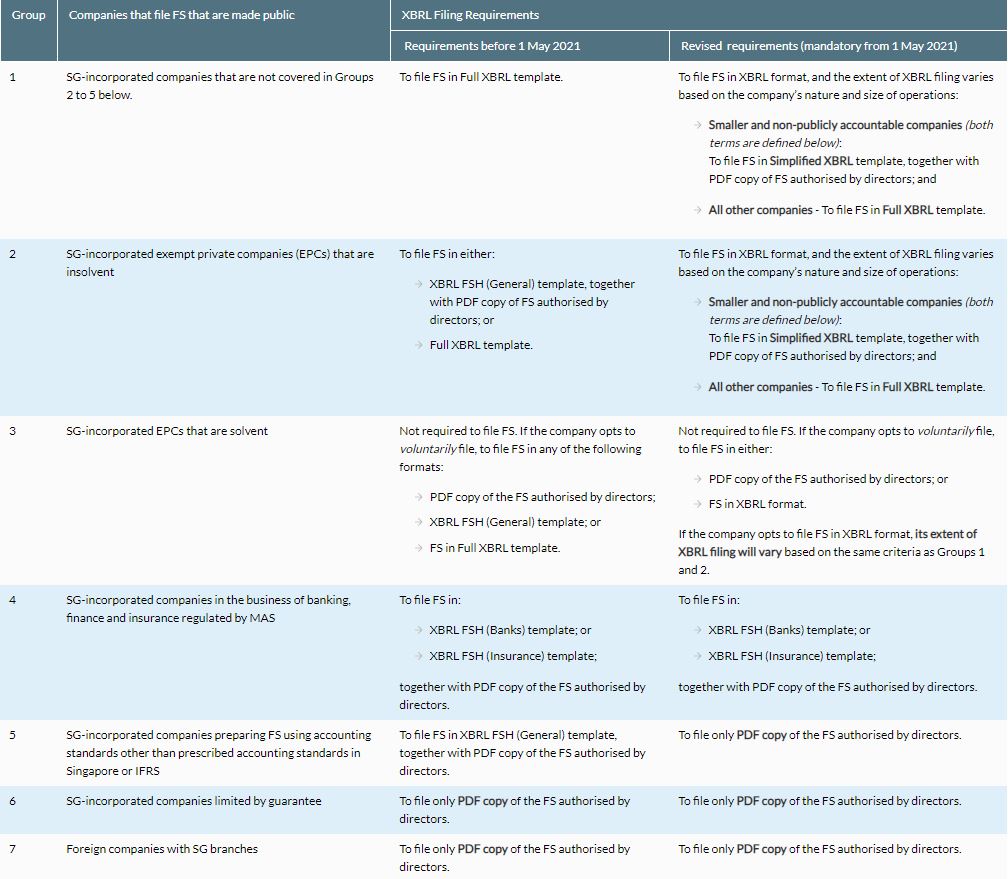

Depending on the type of company and its financial situation, you can refer to the following table to find out which format of financial report your company needs to file.

What companies require mandatory XBRL?

XBRL is mandatory for companies with one shareholder, or for companies with an operating individual holding, whose financial status is insolvent, or for companies with more than 50 shareholders.

Can I prepare XBRL myself?

In Singapore, the task of XBRL filing is to convert the company’s financial data into XBRL format. You must use a library of tags prescribed by ACRA, which requires a range of specialized knowledge such as understanding XBRL tags, when and where to apply them to data, etc. Because filling out XBRL is quite time-consuming, it is quite difficult for employees who lack relevant experience. In addition, company directors are held accountable for the accuracy of the information submitted.

Leaving the XBRL filing to the professional accountants at TASSURE ASIA GROUP gives you peace of mind and peace of mind. We will follow the Singapore Financial Reporting Standards (SFRS) and the SFRS for small entities while ensuring your company’s compliance. For a small fee, you can save a lot of time and reduce potential errors and risks.

*This article is an original article of TASSURE ASIA GROUP and is not allowed to be reproduced.