If your company is running a business in Singapore, or if you and your family are living in Singapore, one of the inevitable issues is taxation. But what are the circumstances under which you, as an individual or a company, need to pay tax? You need to understand the definition of “tax resident” in Singapore and take into account your own circumstances to determine whether you or your company is subject to tax in Singapore.

Individual tax regulations

Individuals (foreigners) are required to pay tax under the Inland Revenue Authority of Singapore (IRAS). Your tax liability depends on your tax resident status.

You will be regarded as a tax resident if you:

a. stay or work in Singapore

i. for at least 183 days in a calendar year; or

ii. continuously for three consecutive years; or

b. work in Singapore for a continuous period straddling two calendar years and your total period of stay* is at least 183 days.

This applies to foreign employees who entered Singapore from 1 Jan 2007 but excludes directors of a company, public entertainers or professionals.

* including your physical presence immediately before and after your employment.

If you are issued with a work pass that is valid for at least one year, you will also be treated as a tax resident upfront. However, your tax residency status will be reviewed at the point of tax clearance when you cease your employment based on the tax residency rules. If your stay in Singapore is less than 183 days, you will be regarded as a non-resident.

Obligations of tax residents

a. You will be taxed on all income earned in Singapore and any foreign-sourced income that was brought into Singapore prior to 1 Jan 2004.

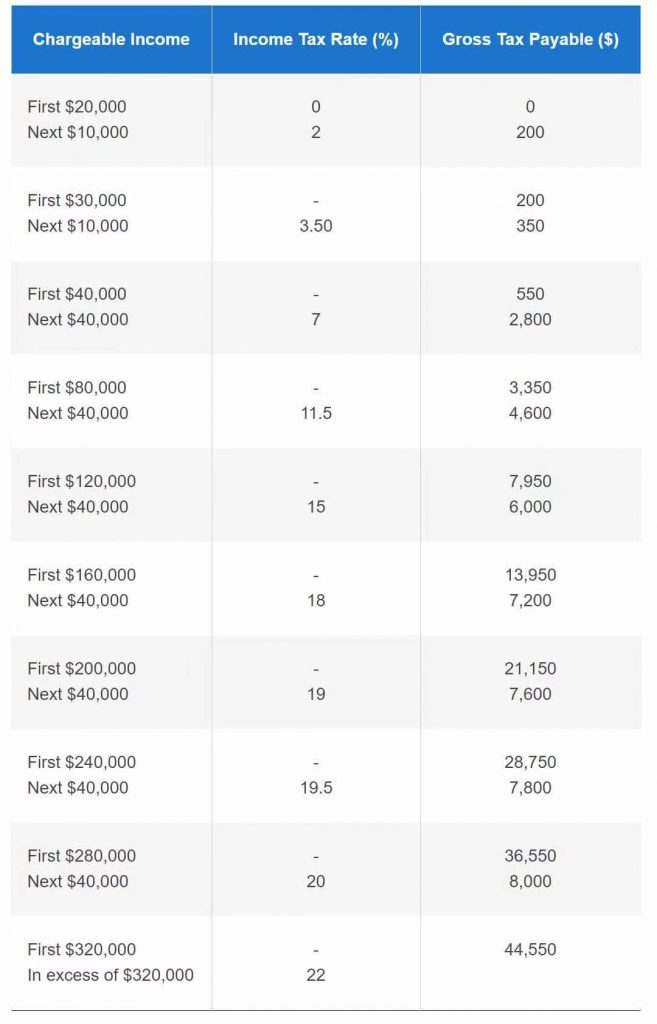

b. Your income, after deduction of tax reliefs, will be taxed at progressive resident rates.

c. Your foreign-sourced income (with the exception of those received through partnerships in Singapore) brought into Singapore on or after 1 Jan 2004 is tax exempt.

Non-Residents (Less than 183 days)

As a non-resident:

1. You will only be taxed on all income earned in Singapore.

2. You will not be entitled to tax reliefs.

3. Your employment income will be taxed at a flat rate of 15% or the progressive resident rates, whichever results in a higher tax amount.

4. Director’s fees and other income such as rent earned in or derived from Singapore will be taxed at the prevailing rate of 22% (20% prior to Year of Assessment 2017).

Corporate Taxation Requirements

According to the Inland Revenue Authority of Singapore (IRAS), a company is a tax resident in Singapore and is subject to taxation when the control and management of the company is exercised in Singapore.

Determining a company’s tax status

A company is either a tax resident or a non-tax resident in Singapore. In Singapore, the tax resident status of a company is determined by the location where the business is controlled and managed. The resident status of a company may change from year to year.

Calculation of corporate tax status

Generally, a company will be considered to be a Singapore tax resident for a particular Year of Assessment (YA) if the control and management of its business was exercised in Singapore in the preceding calendar year. For example, a company is a Singapore tax resident for YA 2020 if the control and management of its business was exercised in Singapore for the whole of 2019.

Conversely, a company is a non-resident when the control and management of the company is not exercised in Singapore.

What is “control and management”?

“Control and management” is the making of decisions on strategic matters, such as those on company policy and strategy. Where the control and management of a company is exercised is a question of fact. Typically, the location of the company’s Board of Directors meetings, during which strategic decisions are made, is a key factor in determining where the control and management is exercised. Under certain scenarios, holding Board of Directors meetings in Singapore may not be sufficient and IRAS will consider other factors to determine if the control and management of the company is indeed in Singapore.

Some examples of scenarios where the control and management of a company is considered not to be exercised in Singapore include:

a. There is no board of directors meeting held in Singapore. Instead, the directors’ resolutions are merely passed by circulation;

b. The local director is a nominee director while the rest of the directors are based outside Singapore;

c. No strategic decisions are made by the local director in Singapore;

d. No key employees are based in Singapore.

Do note that the place of incorporation of a company is not necessarily indicative of the tax residence of a company.

It is important to note that the tax residency status of companies may be affected due to the travel restrictions of COVID-19. You can scan the QR code below to refer to the latest Internal Revenue Service of Singapore (IRAS) policy on “Tax Residency Status of Companies and Permanent Establishments” for more information.

Foreign Company with Singapore Branch

Foreign-owned investment holding companies*

Foreign-owned investment holding companies, with purely passive sources of income or receiving only foreign-sourced income are generally regarded as non-residents because these companies usually act on the instructions of its foreign companies/shareholders.

However, they may still be treated as Singapore tax residents if they are able to satisfy IRAS that certain conditions have been met. For details on the conditions, refer to Applying for COR for Foreign-Owned Investment Holding Companies.

————————-

* A foreign-owned company is a company where 50% or more of its shares are held by:

a. Foreign companies which are incorporated outside Singapore; or

b. Individual shareholders who are not citizens of Singapore.

The ownership is to be applied at the ultimate holding company level.

Non-Singapore Incorporated Companies and Singapore branches of foreign companies

Non-Singapore incorporated companies and Singapore branches of foreign companies are controlled and managed by their foreign parent and are, therefore, regarded as non-residents. However, they may still be treated as Singapore tax residents if they are able to satisfy IRAS that certain conditions have been met. For details on the conditions, refer to Applying for COR for Non-Singapore Incorporated Companies.

Impact of Tax Residency on Foreign Income

While resident and non-resident companies are generally taxed in the same manner, resident companies enjoy certain benefits. Some of these benefits relate to income from foreign sources.

Some benefits tax resident companies enjoy include:

a. tax benefits provided under Avoidance of Double Taxation Agreements (DTAs) Singapore has concluded with other jurisdictions;

b. tax exemption on foreign-sourced dividends, foreign branch profits, and foreign-sourced service income under section 13(8) of the Income Tax Act; and

c. tax exemption for new start-up companies.

You will need to decide whether to take advantage of or apply for these tax benefits based on your company’s actual situation.

In summary, the determination of individual or corporate tax resident status affects whether you should pay tax and how much tax you pay. Some policies may also be affected during special times of coronavirus epidemics. You can always contact our service team to update you on the latest government information and policies, and we hope this article will answer some of your questions.