One of the inevitable issues after you set up your Singapore company is to set up the Financial Year End (FYE) of your company, which is very important for every company, but the financial year does not necessarily need to end on 31 December. So which date should you choose as the end of your company’s fiscal year? TASSURE ASIA GROUP will tell you more in this article.

Why is FYE important?

The establishment of the FYE determines the following three important time cut-off points

- Estimated Chargeable-Income (ECI)

- Annual General Meeting (AGM)

- Annual Returns Filing

But most importantly: your company’s Year of Assessment (YA) will also be based on the FYE. By choosing the right FYE, you can make the most of the tax relief.

How to choose the right FYE?

Common practice

The Accounting and Corporate Regulatory Authority of Singapore (ACRA) allows a newly formed company to declare its first financial year end date (FYE) within 18 months from the date of incorporation.

Therefore, it is not uncommon for new business owners or entrepreneurs to set their FYE to 31 December. For one thing, it is easy to remember, and for another, this option is the most common and can be considered a very safe practice provided that it meets government requirements.

But is this the best approach? Not necessarily, you can refer to the following instructions:

A better approach

A better approach, in fact, is not to simply set the first year FYE to 31 December. The main reason for this is that this maximizes the tax relief available to newly incorporated companies from the Internal Revenue Service of Singapore (IRAS).

The general rule for a new company to take maximum advantage of tax relief is to try to ensure that the base period for its first Year of Assessment (YA) is as long as possible within the 12-month limit.

FYE calculation formula

If you want to maximize your company’s tax deductions, you can refer to the following formula to set your FYE.

- Add 1 year to the company’s date of incorporation

- Subtract 1 month

- Choose the last day of the month

For example, if a company is incorporated on February 20, 2021, the FYE should be selected as follows:

- Add 1 year to the date of incorporation: February 19/20, 2022

- Subtract 1 month: January 19/20, 2022

- Select the last day of the month: January 31, 2022

Accordingly, the company’s first fiscal year will be from February 20, 2021 to January 31, 2022. Thereafter, the fiscal year ends on January 31 of each year, i.e. January 31, 2023, January 31, 2024 …… and so on (unless explicitly changed).

How does the FYE relate to corporate tax relief?

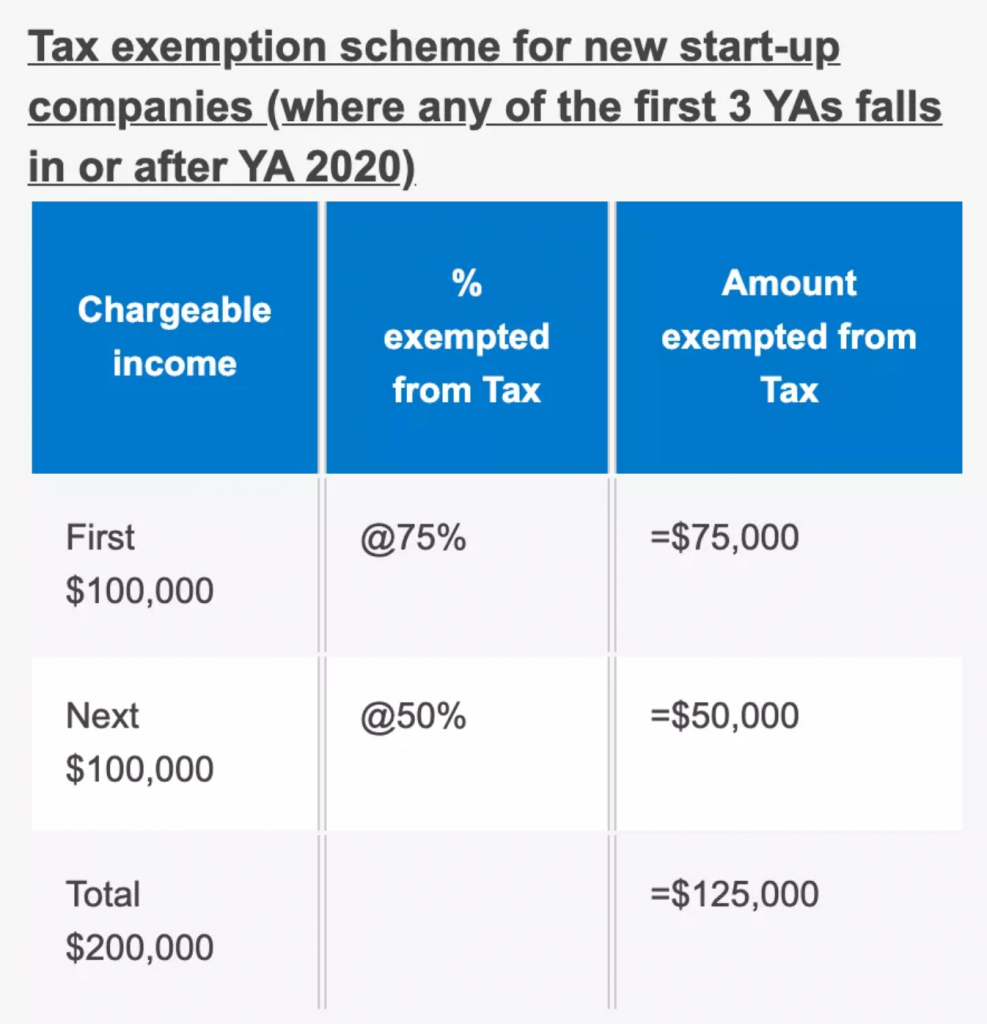

Each company’s tax assessment year (Year of Assessment), or YA, is based on the FYE, which cannot exceed 12 months, and the tax is calculated based on the YA. Starting from YA2020, IRAS tax relief for the first 3 years for new companies is as follows.

Case Study

According to IRAS, suppose the date of incorporation of company A is 13 July 2020 and its chargeable income (FYE) does not exceed S$100,000 per year. Then if different FYEs are set, the following possible outcomes will occur.

[Scenario 1]

Company A sets the first year FYE to 31 December 2020, then

- Company A’s first FYE is from July 13, 2020 to December 31, 2020

- Company A’s first tax assessment year (Year of Assessment ) YA2021 will be calculated for the six-month period July 13, 2020 – December 31, 2020

Based on the exemption percentages in the table above, Company A’s 75% tax deduction for its first YA, YA2021, will only apply for the period July 13, 2020 – December 31, 2020, a total of 6 months

[Scenario 2]

Under the ACRA, a new company can declare its FYE for a maximum of 18 months. then under this provision, assuming that Company A sets its first year FYE to December 31, 2021 (without exceeding the maximum 18-month period under the ACRA), then

- The calculation and tax deduction for Company A’s first FYE and YA2021 is the same as in Case 1

- Company A’s second fiscal year is from January 1, 2021 to December 31, 2021

- Company A’s tax assessment year YA2022 will be calculated for the 12-month period from January 1, 2021 to December 31, 2021

According to the tax exemption percentage in the table above, Company A’s 75% tax deduction in YA2021 applies from July 13, 2020 to December 31, 2020, for a total of 6 months, while YA2022 applies from January 1, 2021 to December 31, 2021, for a total of 12 months. Therefore, Company A only enjoys 6 months of tax relief in YA2021, while YA2022 enjoys 12 months of tax relief.

[Scenario 3]

Following the previous formula, Company A sets the FYE to June 30, 2021, then

- Company A’s first FYE will be July 13, 2020-June 30, 2021

- Company A’s first YA will be YA2022, and YA2022 will be calculated using the 12-month period July 13, 2020 – June 30, 2021

- Based on the tax exemption percentage in the table above, Company A enjoys a 12-month tax deduction for the first YA, YA2022. The maximum tax relief is enjoyed.

So, in summary, according to the formula we introduced, the setup of case 3 allows your company to enjoy the maximum tax relief in the first YA.

Contact us for professional advice

Although we have provided you with a formula that you can use to choose your FYE, it is not absolute. If you have any questions, you can contact TASSURE ASIA GROUP’s service team to answer your questions.